The impact of COVID-19 on the Textile industry, according to an ITMF survey

The coronavirus crisis has thrown the world economy into chaos. All industrial sectors have suffered irreversible changes from all perspectives and, even though the end of the pandemic is increasingly …

The coronavirus crisis has thrown the world economy into chaos. All industrial sectors have suffered irreversible changes from all perspectives and, even though the end of the pandemic is increasingly in sight, the road ahead remains unpredictable and uncertain.

For the textile sector, there has been no exception, the pandemic has hit hard all parts of the value chain: from sales and distribution to textile manufacturing and workshop production, also including textile machinery producers.

The 7th ITMF Corona Survey

The study organized by the International Textile Manufacturers Federation analyzes the situation of the orders around the textile chain by the various lockdowns announced in Europe but turned over into a series of surveys to provide information about the global textile industry in different regions, including various segments of the textile value chains such as the chemical and textile machinery.

We are aware of how uncertain this year has been, but thanks to this kind of studies we can see how the whole textile value chain moves towards a recovery.

EAS would like to share some of the 7th ITMF Corona-Survey reviews, to contribute, as the ITMF says, to “better understand the dynamics and underlying forces facing our industry”.

In the general background, the results have revealed an optimistic message for the global textile industry, as reported, “survey participants see light at the end of the pandemic tunnel”.

1. The impact of the covid-19 for regions

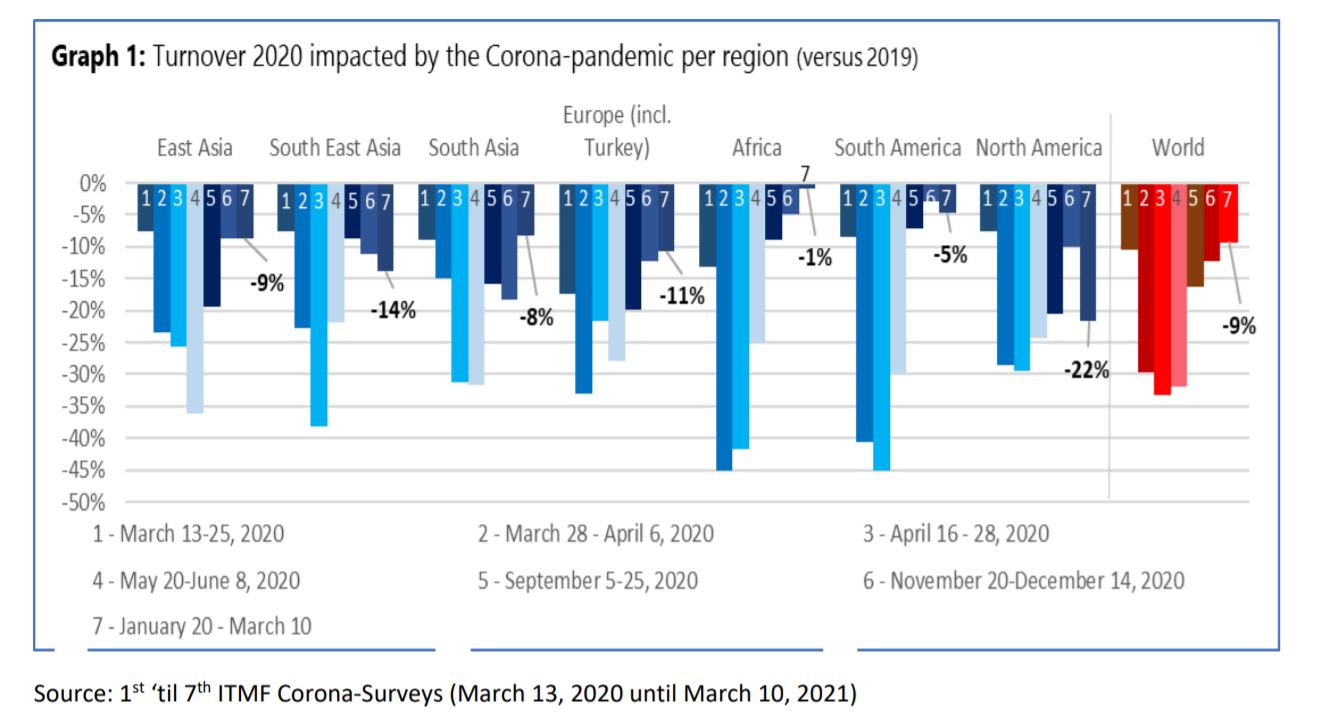

The survey revealed that actual turnover worldwide in 2020 was -9% lower compared to 2019, a decrease that is significantly better than the expected drop of -33% in results of previous surveys conducted with the pandemic in development.

EE. UU, Europe, and South East Asia were the regions most affected.

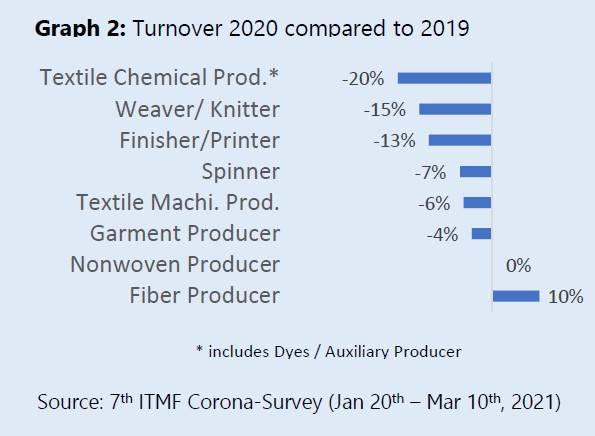

Most of the textile chains were hit hard by the pandemic, but the segment’s producer of nonwovens and of fibers standing out positive. It is intuitive because they have benefitted from the extraordinary demand for masks during 2020.

Textile chemical producers, including dyes and auxiliary producers, and finishers/printers are the segment of all the value chain in the textile industry where turnover 2020 is down between 13% to 20%, being most affected.

In another way, spinner, textile machinery, and garment producers were the least affected, with its turnover down between -4% to -7%.

2. Growth forecast for the near future

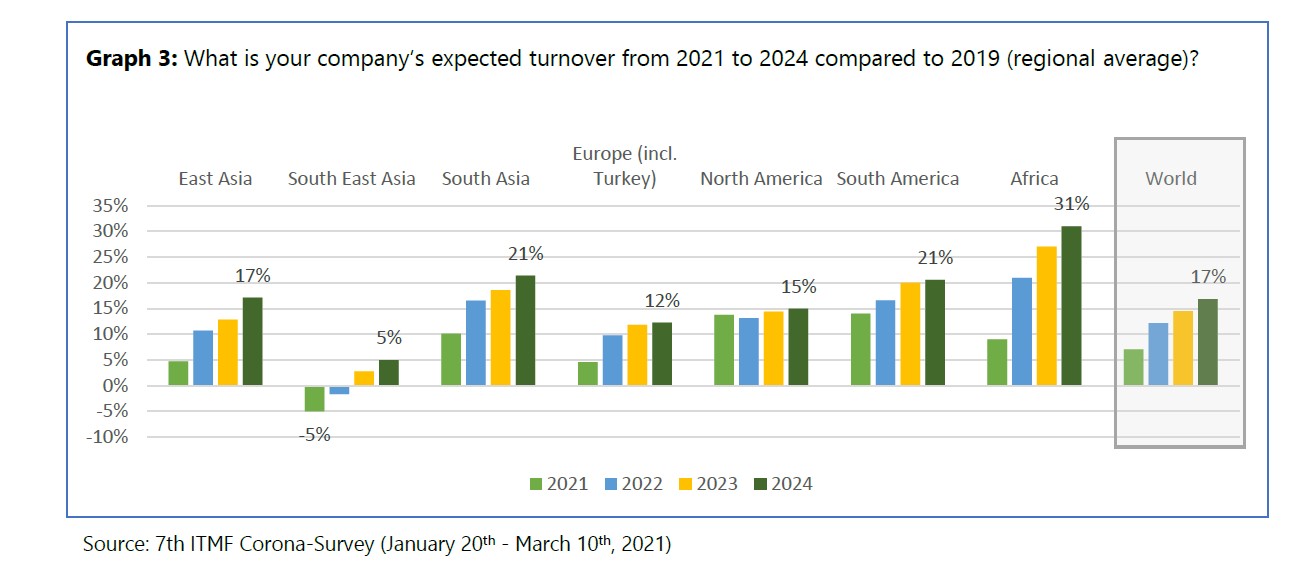

According to the ITMF survey, turnover expectations on a global level are especially strong for 2021 and 2022, and for 2023 and 2024 companies’ growth expectations are weaker.

As you can see in the graph below, Asia is the region with the most positive turnover expectation compared to the other regions.

3. Current turnover levels

Global turnover (textile world) is expected to increase by more than 17% on average until 2024, compared to 2019.

By the end of four quarterly 2021, 31% of the companies have reached their pre-crisis turnover levels, and another 47% of the companies expect to recover during this 2021.

4. Investments in higher automation level

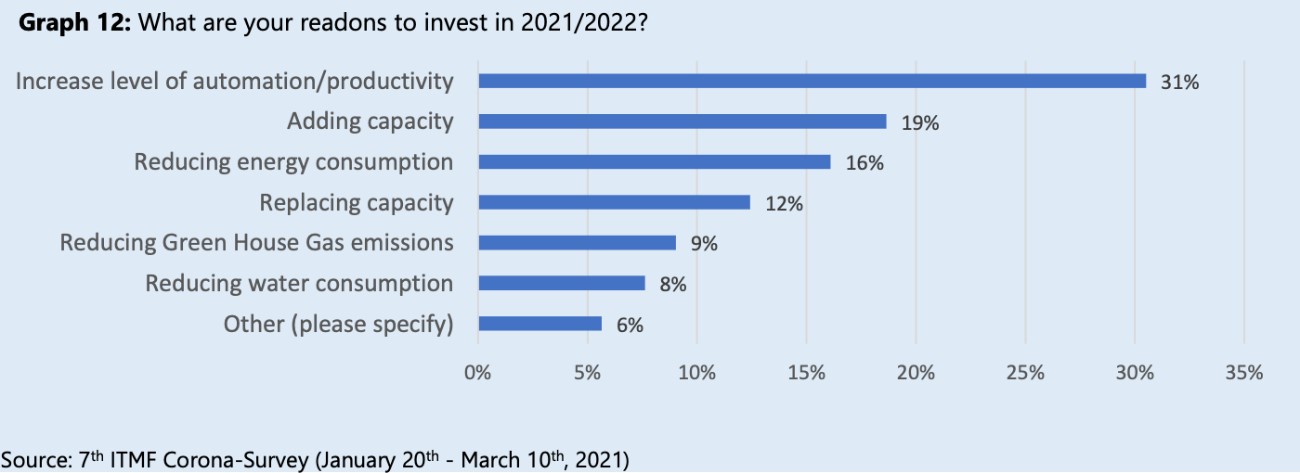

The ITFM surveys also revealed that most companies have the intention to invest in the following years. Their main reasons to do it are to increase levels of automation and levels of productivity, adding capacity, and reducing energy consumption.

Nowadays, the automation is an essential that can help improve the entire textile production chain.

For example, EAS helps dyeing houses and finishing textile companies in the automation of their textile production, offering solutions at the service of the textile plant, such as weaving, knitting, dyeing, and finishing.

Read the ITMF’s press release on the 7th ITMF Corona Survey, and if you want more information about our services please write to us.